What Does Clark Wealth Partners Do?

Some Ideas on Clark Wealth Partners You Should Know

Table of ContentsClark Wealth Partners for BeginnersSome Ideas on Clark Wealth Partners You Need To KnowGetting The Clark Wealth Partners To WorkClark Wealth Partners - An OverviewThe Best Guide To Clark Wealth Partners8 Simple Techniques For Clark Wealth PartnersSome Known Details About Clark Wealth Partners The Best Guide To Clark Wealth Partners

There's no solitary path to becoming one, with some people starting in financial or insurance coverage, while others start in audit. A four-year level provides a solid foundation for jobs in investments, budgeting, and customer services.Several ambitious organizers invest one to three years building these sensible abilities. 3Although not lawfully required, the CFP credential is widely considered the industry gold criterion. The exam is offered three times annually and covers locations such as tax obligation, retired life, and estate preparation. 4To make the CFP designation, you have to finish either 6,000 hours of professional experience or 4,000 hours with the Apprenticeship Pathway.

Usual examples include the FINRA Collection 7 and Series 65 examinations for safety and securities, or a state-issued insurance license for selling life or medical insurance. While credentials may not be legitimately needed for all intending functions, companies and customers usually view them as a benchmark of expertise. We consider optional credentials in the next section.

Unknown Facts About Clark Wealth Partners

Most financial coordinators have 1-3 years of experience and experience with monetary items, compliance standards, and direct customer interaction. A strong academic history is vital, however experience shows the capacity to use theory in real-world setups. Some programs incorporate both, allowing you to finish coursework while gaining monitored hours through internships and practicums.

Early years can bring long hours, stress to develop a customer base, and the requirement to consistently verify your experience. Financial coordinators delight in the opportunity to function very closely with clients, guide vital life decisions, and typically attain adaptability in timetables or self-employment.

The Main Principles Of Clark Wealth Partners

The yearly average wage for these specialists was $161,700 as of 2024. To end up being an economic organizer, you usually need a bachelor's level in finance, economics, company, or an associated subject and several years of appropriate experience. Licenses may be required to offer safeties or insurance, while qualifications like the CFP boost reliability and job possibilities.

Optional certifications, such as the CFP, typically require extra coursework and screening, which can expand the timeline by a pair of years. According to the Bureau of Labor Data, individual monetary advisors gain a median yearly annual income of $102,140, with top earners gaining over $239,000.

All about Clark Wealth Partners

To fill their footwear, the country will certainly require even more than 100,000 new monetary consultants to enter the market.

Assisting people attain their financial goals is a monetary advisor's key feature. Yet they are additionally a small company owner, and a portion of their time is committed to handling their branch office. As the leader of their technique, Edward Jones monetary experts require the management skills to hire and manage team, along with the service acumen to develop and perform a company method.

Some Known Questions About Clark Wealth Partners.

Edward Jones financial consultants are encouraged to seek added training to expand their understanding and abilities. It's likewise an excellent idea for financial consultants to participate in industry seminars.

That indicates every Edward Jones affiliate is free to concentrate 100% on the client's benefits. Our partnership framework is collaborative, not affordable. Edward Jones monetary advisors take pleasure in the assistance and camaraderie of other monetary consultants in their region. Our monetary experts are urged to provide and obtain support from their peers.

Some Known Details About Clark Wealth Partners

2024 Lot Of Money 100 Ideal Firms to Help, released April 2024, research study by Great Places to Work, information as of August 2023. Compensation attended to utilizing, not acquiring, the score.

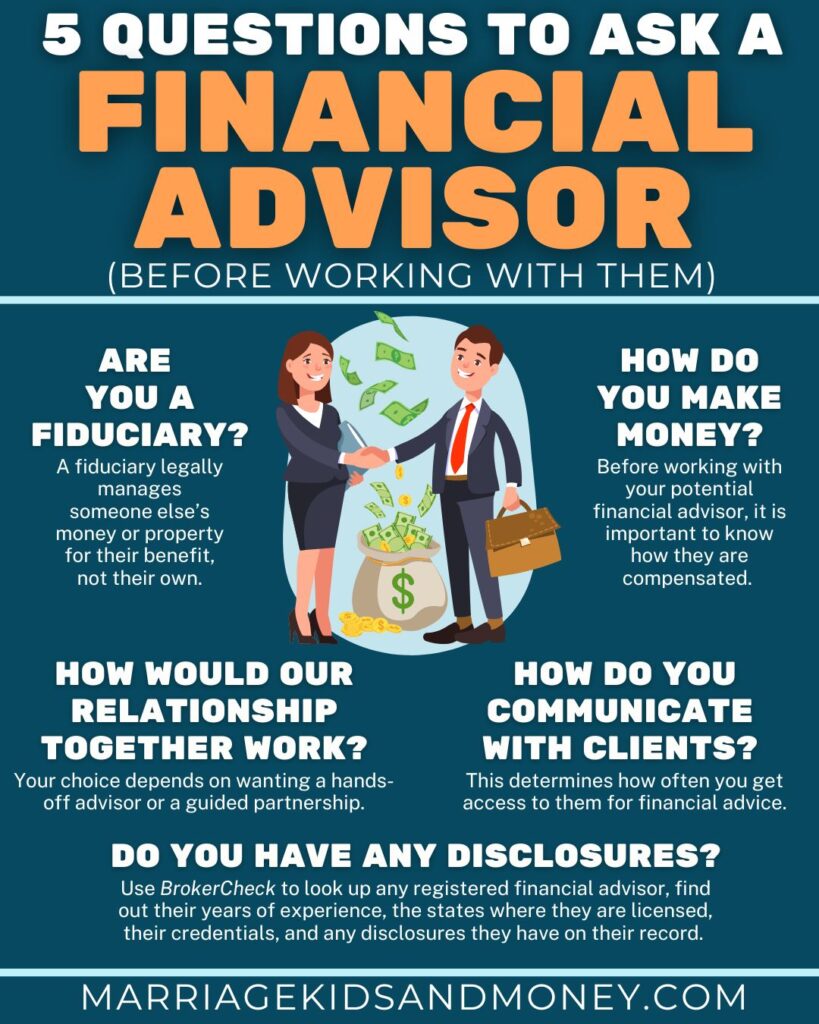

When you need aid in your monetary life, there are numerous specialists you may look for guidance from. Fiduciaries and monetary experts are 2 of them (financial advisor st. louis). A fiduciary is a specialist that manages cash or home for other celebrations and has a legal duty to act only in their client's benefits

Financial experts ought to schedule time each week to fulfill brand-new individuals and catch up with the people in their ball. Edward Jones monetary advisors are fortunate the home workplace does the hefty lifting for them.

6 Simple Techniques For Clark Wealth Partners

Continuing education is a necessary part of maintaining a monetary consultant permit. Edward Jones financial consultants are motivated to go after additional training to broaden their expertise and skills. Commitment to education Learn More protected Edward Jones the No. 17 area on the 2024 Training peak Awards list by Educating publication. It's likewise an excellent concept for financial experts to participate in industry meetings.

Edward Jones financial experts delight in the assistance and camaraderie of other economic advisors in their area. Our monetary experts are encouraged to provide and get assistance from their peers.

2024 Ton Of Money 100 Best Business to Help, published April 2024, research by Great Places to Work, data as of August 2023. Payment offered using, not getting, the rating.

8 Easy Facts About Clark Wealth Partners Explained

When you need help in your economic life, there are several specialists you may seek assistance from. Fiduciaries and monetary experts are two of them. A fiduciary is a professional that takes care of money or property for various other celebrations and has a lawful responsibility to act only in their client's benefits.